Payday Super for employers and employees is coming in 2026

July 30, 2025In the 2023-24 Budget, the Government announced a reform to align employers’ payment of Superannuation Guarantee (SG) contributions with salary and wages, instead of the current quarterly requirement. This will take effect from 1 July 2026.

This will strengthen Australia’s superannuation system and help deliver a more dignified retirement to more Australian workers by tackling unpaid superannuation. The non-payment and underpayment of superannuation by employers risks the retirement income of millions of Australians. Non-payment and underpayment of superannuation is equivalent to wage theft and has significant impacts on retirement outcomes.

Around 8.9 million employees will benefit from higher retirement savings from receiving their superannuation contributions earlier and more frequently throughout their working life. These reforms will deter superannuation theft and enable the ATO to take quick action to rectify instances of unpaid superannuation.

More frequent payment of superannuation will empower employees to track their entitlements and make it harder for them to be exploited by disreputable employers. Employees will be able to see these payments by reviewing their superannuation account transactions, and will be able to hold employers to account by raising non-compliance directly, or through the Fair Work Ombudsman or the ATO.

More frequent superannuation payments will also make employers’ payroll management smoother with fewer liabilities building up on their books.

This will complement the Government’s other actions to strengthen the superannuation system including increasing the SG rate to 12 per cent by 1 July 2025, paying super on Government Paid Parental Leave, including superannuation as an entitlement in the National Employment Standards, criminalising superannuation theft, legislating the Objective of Superannuation, making super concessions fairer, improving the equity and sustainability of superannuation tax concessions, and expanding the coverage of the annual performance test.

Employers will need to pay SG alongside wages

From 1 July 2026, an employer will be required to make SG contributions on ‘payday’.

Payday is the date that an employer makes an Ordinary Time Earnings (OTE) payment to an employee.

Each time OTE is paid, there will be a new 7 day ‘due date’ for contributions to arrive in the employees’ superannuation fund. This provides time for the movement of funds through the payment system, including clearing houses. An employer will be liable for the new SG charge unless SG contributions are received by their employees’ superannuation fund within 7 calendar days of payday.

There will be some limited exceptions:

- Contributions for OTE paid within the first two weeks of employment for a new employee will have their due date deferred until after the first two weeks of employment.

- Small and irregular payments that occur outside the employee’s ordinary pay cycle would not be considered a payday until the next regular OTE payment or ‘payday’ occurs.

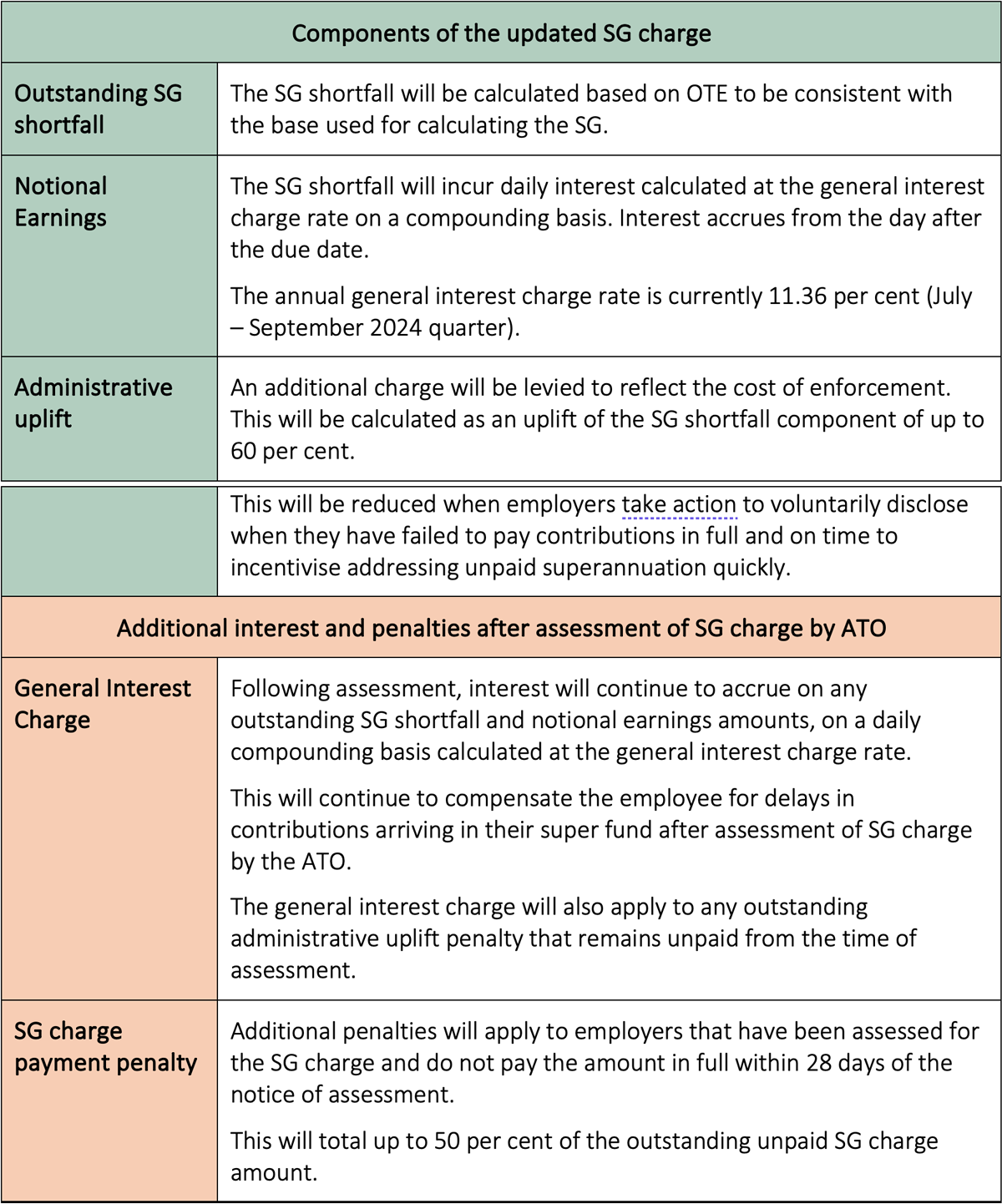

An updated SG charge

Where employers fail to pay contributions in full and on time, they are liable for the SG charge.

The SG charge is being updated for the payday super environment and will continue to reflect the seriousness of underpayment or late payment of SG.

The SG charge will ensure that employees are fully compensated for any delay in receiving their super. It will also create an incentive for employers to address unpaid superannuation quickly.

The updated SG charge framework will:

- put workers in the same position as if the contributions had been received in full and on time;

- incentivise employers to quickly disclose and rectify any instances of unpaid superannuation; and

- scale up consequences for employers who don’t pay on time, with bigger penalties for employers who repeatedly do the wrong thing.

All assessments of the updated SG charge will be made by the ATO. Assessments would be triggered where there is non-payment detected by the ATO, which could occur by voluntary disclosure of an employer, an employee notification or the ATO’s proactive compliance. Additional interest and penalties apply if the assessed SG charge is not paid by the due date.

The SG charge will be tax-deductible, ensuring the income tax consequences for paying employees’ superannuation are consistent. Any penalties and interest after assessment of SG charge by the ATO will not be deductible.

Like the current system, an employer’s shortfall and SG charge will be increased where they fail to comply with the rules around giving the employee their choice of fund and following that choice.

Recognising late contributions

Employers will need to pay SG contributions on payday, so they are received in an employee’s super account within 7 calendar days of payday.

If funds are not received in an employee’s superannuation account within 7 days, the employer will be liable to pay the SG charge, even ahead of the ATO issuing an assessment. An employer in this situation should make contributions to their employee’s superannuation fund as soon as possible. This will minimise their liability and penalties.

The longer the period of non-compliance, the larger the SG Charge will be. Employers need to ensure they have the correct governance and systems in place to ensure their workers receive their full legal entitlements, including salary, wages and SG, on time.

The approach to correcting late contributions will be simplified under payday super. Employers will no longer need to make an election or choose which period for which each late contribution should count. Contributions will now automatically count towards the earliest possible payday that has not yet been assessed for SG charge, and which still has an outstanding SG shortfall.

Supporting transition to Payday Super

Several changes are being made to support the transition to Payday Super and protect employees in the onboarding process:

- The deadline for superannuation funds to allocate or return contributions will be reduced to three business days, down from 20.

- The SuperStream data and payment standards will be revised to allow payments via the New Payments Platform and improve error messaging to ensure employers and intermediaries can quickly address errors.

- Given the improvement in payroll software solutions over recent years provides employers with cost-effective and more fit for purpose options for paying superannuation contributions on payday, the ATO’s Small Business Superannuation Clearing House will be retired from 1 July 2026. The ATO will engage with small businesses ahead of time to support them in transitioning to an alternative that is fit-for-purpose for Payday Super.

- Revised choice of fund rules will make it easier for employees to nominate their superannuation fund when they start a new job. Employers will be able to show employees their existing ‘stapled’ fund during onboarding, as part of the choice of fund. This will reduce the risk of unintended duplicate accounts and give employers more timely and accurate details.

- Advertising of superannuation products during onboarding will be limited to MySuper products that have passed the most recent performance test to protect employees from poor outcomes.

ATO’s compliance approach

The ATO will have increased visibility of SG contributions across the employer population, by matching employer Single Touch Payroll (STP) data and superannuation fund reporting. This visibility will allow the ATO to proactively identify missing or late SG payments and intervene sooner to ensure employers can get back on track with their superannuation before problems escalate.

The onus will be on employers to make sure they pay SG at the same time they pay their employees’ wages. Employers who repeatedly fail to pay on time and fail to disclose promptly will be exposed to the maximum administrative uplift component of the SG charge. Where employers promptly disclose their failure to pay SG on time, the amount of administrative uplift they must pay will be reduced. The ATO will streamline services for employers’ voluntary disclosures.

To facilitate this compliance, employers will be required to report in STP both the OTE and the total superannuation liability for an employee, ensuring the SG can be correctly identified.

This will also mean that employees that previously had to wait up to 4 months to determine whether they had been paid SG will be able to check their superannuation account as their wages are paid to determine if their employer is meeting their obligations. This will empower employees to take action before large amounts of unpaid SG accrues, including by raising it directly with their employer, submitting an employee notification form to the ATO, or raising it with the Fair Work Ombudsman.

Contact Indigo Financial on (08) 8212 8585 if you need help with any of your accounting and taxation needs.

Note: The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.

Back to News Page